The Single Strategy To Use For Red Rock Mortgage Las Vegas Review - FREEandCLEAR

Conventional Loans - Superior Mortgage Lending, LLC.

Everything about Reverse Mortgage Jobs, Employment - Indeed.com

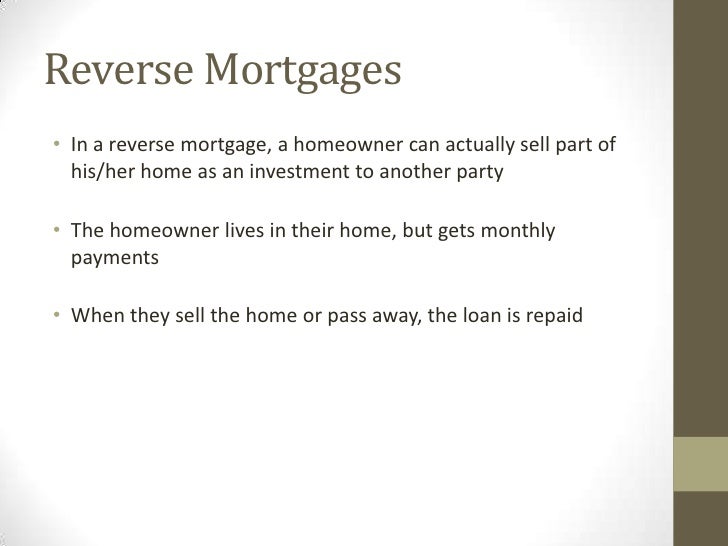

Desire to access the equity in their house to supplement their income or have money available for a rainy day. Some people even use a reverse home loan to remove their current mortgage and improve their month-to-month capital, states Peter Bell, president and CEO of the National Reverse Home Loan Lenders Association.

Sun City AZ's #1 Reverse Mortgage Lender - HUD Approved

"In some cases, people may have an immediate requirement to pay off financial obligation, or they might have had some unexpected expenses like a home repair or health care situation." The bank makes payments to the customer throughout his/her lifetime based on a percentage of accumulated home equity. The loan balance does not have actually to be paid back till the customer passes away, sells the house or completely moves out.

When does it need to be paid back? When the customer passes away, offers the home or permanently moves out. Who is eligible? Seniors 62 and older who own homes straight-out or have little mortgages. How can money be utilized? For This Is Noteworthy . Retired people normally use money to supplement earnings, spend for health care expenses, settle financial obligation or financing house enhancement tasks.

The 7-Minute Rule for Ask an Attorney: Should I consider a reverse mortgage? - Las

And if the balance is less than the value of your house at the time of payment, you or your successors keep the distinction. Just how much can you get? According to the National Reverse Mortgage Lenders Association, or NRMLA, numerous aspects figure out the amount of funds you are eligible to get through a reverse home loan.

Reverse Mortgage: What to Know About Reverse Mortgages

Value of home. Rate of interest. Lesser of appraised value or the HECM FHA home mortgage limitation of $625,500. To be eligible for a reverse home loan, you need to either own your house outright or have a low home loan balance that can be paid off at the closing with proceeds from the reverse loan.

Generally, the older you are and the more valuable your home, the more cash you can get. There are no limitations for how the cash from a reverse home mortgage loan need to be used. Many individuals in retirement use it to supplement their earnings, spend for health care expenditures, settle financial obligation or spend for house improvement jobs.